A global cement clinker war has started

Jun 16,2019

One of the long-term trends in the cement industry is overcapacity. Recently, many news reports have paid attention to this point, because different participants have different reactions to the changing trend of international trade in clinker and cement.

The Bangladesh Cement Manufacturers Association wants the government to cut import tariffs on clinkers.

Algeria's transition from a cement importer to an exporter continues.

Armenia and Afghanistan are responding to cement imports from neighbouring Iran.

Pakistani cement exporters, who are losing ground in Afghanistan, are again lobbying South Africa to lift anti-dumping measures.

In Barbados, the dispute between Hard Rock cement and Arawak cement may have paved the way for the development of Hard Rock cement, as the Caribbean Court has ruled in favour of reducing import tariffs.

Recently, it has been reported that the Rwandan Bureau of Standards has banned the import of cement from Uganda on the grounds of quality requirements.

In short, all this excess clinker and cement can cause controversy and market distortions when new markets are discovered.

Usually, when major local businesses defend their territory and talk openly about "quality issues", potential unemployment and the blow to the local economy, the media normally report negative news. However, this is not always the case. In Afghanistan, although the Chamber of Commerce and Industry wishes to promote cement produced locally, it also welcomes imports and discusses the advantages of cement from different sources. The same is true in Bangladesh, which is dominated by grinding, and the industry naturally wants to cut raw material costs.

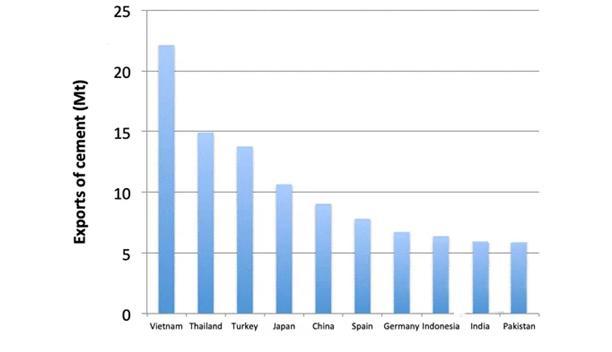

Figure 1: Main Cement Exporting Countries in 2018

Data source: International Trade Center

Overcapacity of cement has caused a series of problems. First, the data in Figure 1 comes from the International Trade Center (ITC), a comprehensive source of trade statistics. Most of its data are consistent with those of government agencies and industry associations, but Iran's export figures are only about one-tenth of the projected export figures for 2018-2019 (about 13 million tons). Similar issues were noted during the last export focus, namely the discrepancy between Vietnamese export data provided by the International Trade Centre and government data.

Regardless of Iran, it's worth noting that the list includes countries that make headlines for exports, such as Vietnam, and countries that have just started doing business quietly, such as Japan's export of 10.7 million tons in 2018. More telling is the change in exports from 2017 to 2018. Exports from Japan, China and Spain declined, while Vietnam, Thailand, Indonesia, Pakistan and South Korea all have grew rate.

Looking around the world, given the obvious huge overcapacity in China, it is the subject. China's cement industry is structurally unable to export cement as other countries do, but this may change as its major companies expand internationally. Nevertheless, in 2018, China became the third largest cement exporter in the United States with an export volume of 2 million tons. However, as the ITC data showing, China's exports fell by 30% in 2018 from a year earlier to 9 million tons, which remains the world's fifth largest cement exporter.

Vietnam, Pakistan and Turkey remain key exporters, ignoring domestic realities and increasing production capacity. For example, Pakistan is stepping out of the construction boom of infrastructure projects in the China-Pakistan Economic Corridor, and all these suppliers are now looking for new markets. Vietnam says it benefits from China's industrial integration. Exports increased 55% year-on-year to 31.6 million tons. In 2018, exports to China reached 9.8 million tons. Vietnam expects the main export markets in 2019 to be the Philippines, Bangladesh, mainland China, Taiwan and Peru. Meanwhile, Turkey faces economic problems in 2018. According to the Turkish Cement Manufacturers Association, Turkish cement exports fell by 6% to 7.5 million tons in 2018. Again, this is contrary to the ITC data, which reported almost twice as much exports as the former.

This is just the tip of the iceberg for a big problem, but as overcapacity continues, such trade disputes will continue. For example, as China reduces cement production, Vietnam may be enjoying supplying cement to China. But what will happen to these Vietnamese factories once Chinese consumption stabilizes? Similar pitfalls await other major exports. At the same time, many multinational cement companies are turning to concrete production. This may be an acknowledgement of the fact that in a clinker-rich world, profits should be sought elsewhere in the supply chain, which is another topic.

EVER LUCKY company are quality supplier for many big cement plants for air pollution control & bulk material handling solution. Our customers major from Vietnam, Pakistan, Bangladesh, Turkey, Iran, Algeria, USA, Indonesia, Thailand, Saudi Arabia, UAE, etc,.

EVER LUCKY company has more than 20 years experience in the manufacturing of bag filter & material handling equipment, we promise we can supply you the best quality product with factory price.

Related dynamics

Contact Us

Email: sales01@everluckymachinery.com

Whatsapp: +86-13722852356

Wechat: ff0082006

Sype: 297338284@qq.com

Tel: +86-317-5660915

Fax: +86-317-8330026

Address: Botou city Hebei province